What is Britain’s attitude to debt in 2017?

Table of contents

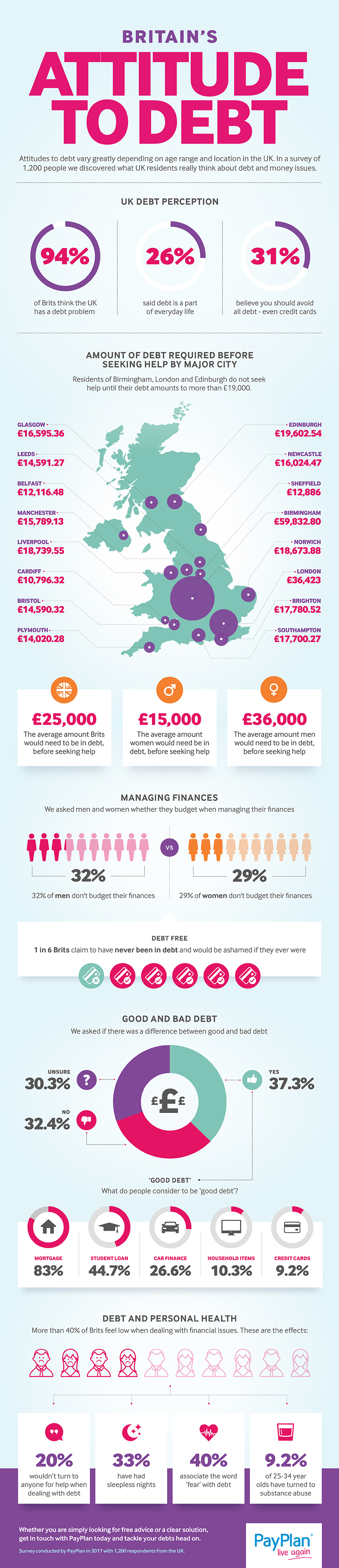

We wanted to know exactly what the people of Britain thought about debt. And so, we asked 1,200 people about their thoughts on the matter, to discern just how serious our debt problem is or if we’ve got things under control.

We asked them questions about debt and whether they considered it something to worry about. How much debt is too much? Do women and men feel differently about the issue? Are credit cards good or bad?

Take a look at the infographic below, which highlights some of the most interesting results of our survey.

Share this Image On Your Site

The results:

Our survey results were surprising in many instances but also gave us a clear overview of what a majority of the population thinks about their finances and making repayments on debt. For example, £25,000 is confirmed to be the average amount most people would take on before seeking help for debt problems – that’s more than a 10% deposit on the average house price in the UK (£218,255.)

The amount of debt required in Birmingham before those making repayments would seek help is a shocking £59,832.80. In the capital, where the cost of living is much higher, £36,423 is considered the highest amount required before needing help – over £20,000 less than Birmingham.

From the survey, we also discovered that women appear to be better at spotting when they require support when it comes to debt, and also when managing their finances overall, with £15,000 considered to the highest amount of debt owed before seeking professional help. Men, however, would allow their debts to reach heights of £36,000! Women were also more likely to budget with only 29% admitting to not planning ahead with their finances.

Surprisingly, while the amounts of debt required before seeking help were high, 31.2% of respondents believe you should avoid debt at all costs – even credit cards!

The reasons for debt occuring were also interesting. The younger people taking part believed that the cost of living and the government are the biggest reasons why people are suffering with debt while those over 55 blame individuals overspending. Brexit was also cited as a reason by a higher amount of 16-24 year olds.

Mortgages are considered to be a ‘good debt’ by an overwhelming 82.8% of respondents, simply because for many it is a necessary loan and something everyone has to take on in order to purchase a home. Student loans are also considered ‘good debt’ as well as debt to cover the cost of home renovations. Unsurprisingly payday loans came at the bottom of the list, along with late bills.

When it came to discerning what the effects of dealing with money issues are, feeling low came out on top as well as sleepless nights and increased tension at home. Interestingly, 47.7% of 55+ year old respondents claim to have never experienced money issues, neither have 35.3% of 16-24 year olds.

Ultimately, our survey discovered that 56.9% of respondents agree that the UK has a debt problem – surprisingly more men than women. If you require any advice when dealing with problem debt don’t hesitate to get in touch for free debt help today.

Comments 3

[…] Payplan has conducted some survey work to better understand attitudes to debt in the UK. Involving 1200 people, the survey considered whether attitudes varied according to gender, location, the nature of the credit and the amount owed before debt advice was sought. A useful infographic providing a snapshot of the results is available on the Payplan website here. […]

Great article, a very interesting read, especially the differences with age groups.

A few questions.

1) The graphic says 94% of Brits think the UK has a debt problem, but the last line in the notes says 56.9%. Is one of these incorrect or am I misreading the two?

2) What is the sample size of Birmingham respondents? I’m wondering the confidence interval for things as, whilst I’m not surprised it’s higher than other areas, I’m surprised it’s that much higher. Perhaps the wider range of cultures and ethnicities is a factor there.

The first is the general perception in the UK and the latter one is the result from out survey. I am afraid I cannot comment on the second sentence. I am interested in your interest, can you tell me what inspired you to get back in touch.

Comments are closed.