UK borrowing costs are rising, but what does it mean?

Table of contents

This year, UK borrowing costs have hit the highest level since 1998 [1] But how does this affect you?.

What are borrowing costs?

Borrowing costs refer to the interest rates and fees you pay when borrowing money from lenders. These costs apply to things like mortgages, loans, and credit cards and can vary depending on the type of loan, the lender, and other factors. Because they’re rising, this means higher payments for many people.

Why are borrowing costs rising in the UK?

In short, rising borrowing costs are a combination of government borrowing needs, inflationary pressures, global economic trends, and central bank actions to control inflation. These factors together make borrowing more expensive for both individuals and businesses.

What does this mean for households and businesses?

Increased borrowing costs impact anyone needing to borrow money – whether that’s for a mortgage, a personal loan, a credit card, or something else.

This may lead to an increase in people struggling to meet payments, which may result in more debt and financial difficulties.

How does inflation affect my debts?

Inflation happens when prices for everyday items like food, petrol, and bills go up. When inflation rises, the value of money decreases. To offset this, lenders often increase interest rates.

Right now, the Bank of England (BoE) reports inflation is at 2.6%, and they hope to bring it down to 2% [2]. But, even with that goal, inflation still impacts your finances.

Since inflation increases your cost-of-living, you may find that more of your income goes towards covering your basic living costs, leaving less for debt repayments. This can make it harder to manage your finances and keep up with your debt.

You might be tempted to use credit cards or take out loans to make ends meet. While this can help in the short term, it adds more debt that you’ll need to pay back eventually, adding more to your financial burden.

If you continue to rely on credit to get by, it can create a cycle where you’re juggling living expenses and growing debt, which makes it more difficult to get ahead and repay your debts.

How do higher interest rates affect my debt?

The base rate, set by the BoE, impacts the cost of borrowing money for things like mortgages, personal loans, and credit cards. The Bank Rate is currently 4.75% (as of 09/01/2025). This will be adjusted again at the beginning of February [3].

Increases in the base rate can lead to:

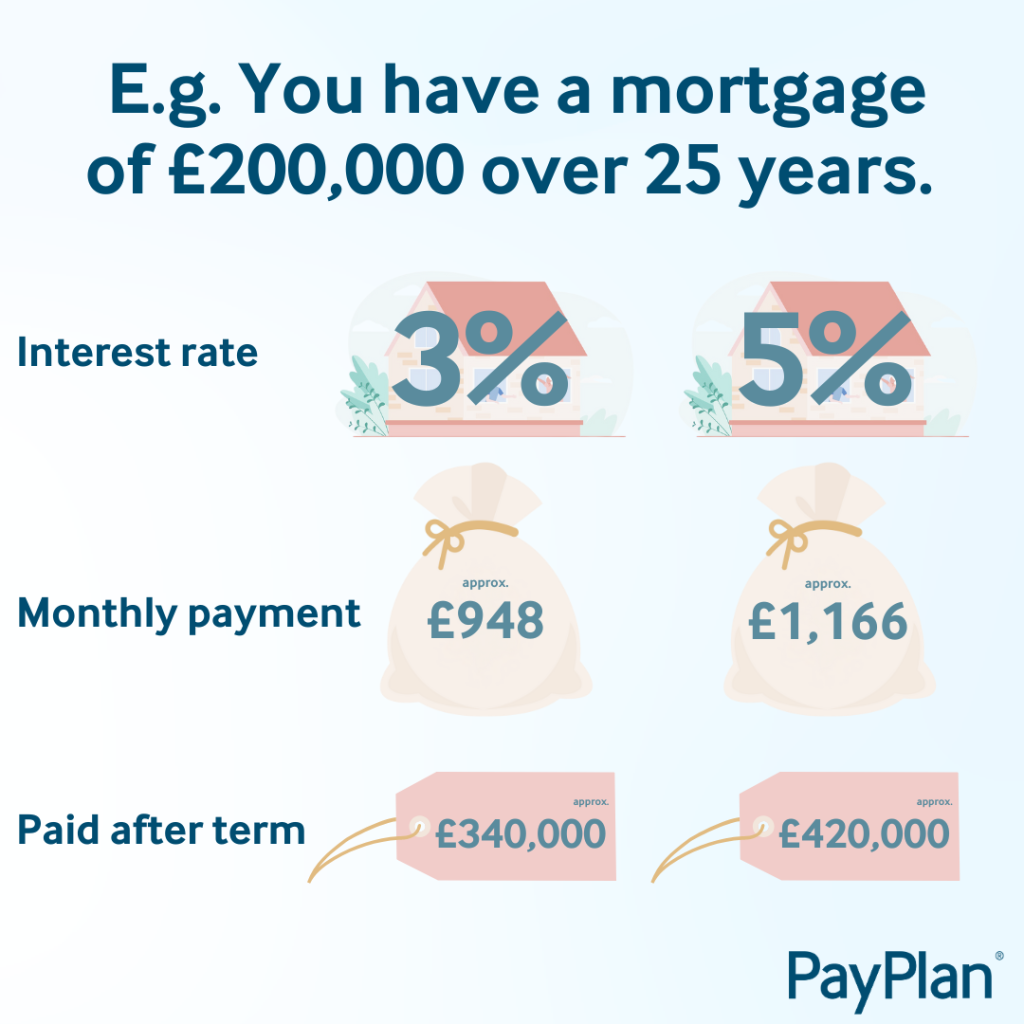

- Higher monthly repayments – when interest rates rise, your monthly repayments for debts with variable rates (like mortgages, personal loans and credit cards) will also increase. This means you’ll be paying more each month, which can make it harder to manage your finances

- Increased total repayment amounts – higher interest rates also mean you’ll end up paying more over the life of your loan

Check out more information on mortgage rates and interest here.

This infographic illustrates how a 2% increase in an interest rate could impact mortgage repayments.

What you can do

If you’re struggling with the cost-of-living, it might be time to look into ways to manage your debt. We can help you find ways to reduce your spending and explore options to manage your debt. Don’t wait until things get worse – take action now to regain control of your finances.

There are lots of ways to get in touch – call us free on 0800 316 1833, speak to us on Live Chat or visit our advice page for more information.